WeFunder the #1 Equity Crowdfunding platform in the USA interviews Oscar Jofre co-founder of KoreConX.

(1) What is a Transfer Agent?

This a great question. As each entrepreneur enters the world of raising capital, new responsibilities are brought on. In many instances, the company will need to engage with a registered transfer agent to manage the corporate records of the company. This can seem like a disconnect since as entrepreneurs know their business best. However, in order to bring confidence to investors, you appoint a third party Transfer Agent, to ensure your book of records are up to date and accurate.

So what is a Transfer Agent?

A stock transfer agent or share registry is a third party company, which records all entries and manages all transactions of the company’s equities. We are holding the book of records for the company and to make sure all trades, transfers and corporate actions are undertaken properly.

(2) What are the requirements for companies that run Regulation Crowdfunding campaigns, with respect to Transfer Agents.

Once you decide to do a Regulation Crowdfunding (RegCF) or RegA+ you will need to undertake a number of regulatory activities before you can get started first, you will need to apply and receive regulatory approval from the SEC. Wefunder provides you all the guidance you need to make sure it’s done correctly and timely.

As you prepare for your offering, you need to start planning for how you will manage and report to all your new shareholders post your capital raise. This can seem overwhelming but we are here to provide you the platform that will help you with all that.

Since you need to appoint a transfer agent, here is what really sets us apart from a traditional transfer agent. We not only provide you the services as mandated, but we also provide a whole platform where you can manage your shareholders, communicate with them, report to them, send them updates, hold your annual shareholders meeting including an included evoting feature and has a free portfolio management feature for your equity and debt holders to always see their investment information and updates. So you can pick a traditional transfer agent that will operate in a silo with none of the above features, or you can select KoreConX that not only meets your regulatory obligations, but also provides you access to an all-in-one platform to help you manage your business.

(3) What are the other services provided by KoreConX?

When we launched KoreConX to serve the JobsAct. It was designed by founders to help founders of a business and to bring everyone together, thus giving companies more control while spending less time doing redundant paperwork.

KoreConX provides the world’s first all-in-one platform providing companies: cap table management, document management, boardroom tools, investor relations, AGM planner, eVoting for shareholders, dealroom, reporting, valuations, and for their shareholders’ a free portfolio management to manage the investments in the company.

The KoreConX all-in-one platform is for by entrepreneurs, CEO, President, CFO, COO, CCO, board of directors, corporate secretary, investor relations, legal counsel, auditors, and shareholders.

One platform to serve the entire company.

(4) What are some of the biggest mistakes you have seen companies make with respect to Transfer Agents?

Having spent over 20 years in the public listed company world, it was not a surprise for us to see some of the issues private companies are facing. For private companies today adding the role of Transfer Agent can be very difficult.

The biggest mistake we see is not disclosing the full captable of the company. This is often because of the way securities have been issued to other shareholders, founders, etc. As the Transfer Agents, the only way to provide proper records is to have all the securities that the company has issued: shares, options, warrants, debentures, SAFE, Digital Assets, Loans, Promissory Notes, etc.

The second biggest mistake we see is that there is no documentation for the securities that have been issued prior to the RegCF offering.

(5) What advice would you have for founders using Transfer Agents?

Like any relationship your company needs to have in the growth of your company, a Transfer Agent is very important.

Find a Transfer Agent firm that not only serves your needs but the needs of your shareholders, and provides you a way to be connected to them in a very effective and efficient manner so you don’t have to keep duplicating your efforts.

A Transfer Agent of the 21st Century needs to grow with you and understand the private company, and how you are going to use regulations to raise your capital.

(6) Why is KoreConx better than Carta?

The major difference with KoreConX and companies like Carta, we design and built KoreConX from the ground up from the founders and the company’s perspective. Most people in the finance industry build products from a transactional and/or a dealermaker perspective.

KoreConX emerged from the creation of the JobsAct and we knew the demands for Transfer Agents would be very difficult to undertake, given the size of the new shareholder bases and that capital raises would be too small to support the added cost of compliance.

We created a platform to help a company who is just getting started through to full maturity.

The KoreConX all-in-one platform is there to help companies of all sizes and providing a journey for an entrepreneur to grow on the platform.

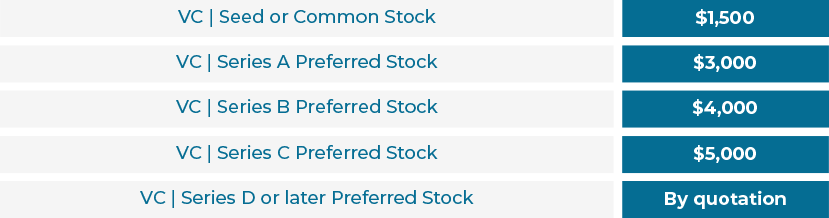

(7) How much does KoreConX cost?

Understanding the Regulation Crowdfunding (RegCF) and RegA+ we knew that pricing for this service would need to be aligned with the company. The service of transfer agent should not be based on the metrics of the past but rather what the companies of today need to operate and meet their regulatory obligations

Our pricing model is there to help companies not punish them.

For RegCF we have a 3 tier pricing model, and this is not based on how many shareholders they will have but rather how much capital they raised:

- $0-$250k $25.00/month

- $250-$500k $50.00/month

- $500k- $1M $75.00/month

All our programs include all the same features:

- Dedicated Agent

- No onboarding fees

- Unlimited transactions

- Investor Relations

- Ability to send reports to shareholders

- Ability to send news releases to shareholders

- Manage your Annual Shareholders Meeting

- Give your shareholders the opportunity to vote online for company Annual Shareholders Meeting

- Free Training for you and your shareholders