In the dynamic landscape of private companies, managing and maintaining an accurate and reliable capitalization table (Cap Table) is paramount. A Cap Table is a detailed ledger that outlines the ownership structure of a company, showcasing the distribution of equity among shareholders. As private companies grow and undergo various funding rounds, mergers, and acquisitions, having a trusted cap table provider becomes indispensable.

What most entrepreneurs do not realize is the importance of the cap table until they are engaging in a transaction of raising capital, M&A, or going public. Your company’s cap table becomes the deal breaker if you are not ready.

This blog explores the significance of a reliable Cap Table and the advantages it brings to private companies when working with a 3rd party provider.

What is a Cap Table Provider?

A Cap Table Provider is a third-party entity that specializes in maintaining and managing your company’s cap table. Their primary role is to ensure that your cap table is accurate, up-to-date, and compliant with all relevant laws and regulations.

This service is especially crucial in the context of raising capital online, where multiple investors may be involved.

A cap table provider has to follow securities and privacy laws, also assuring companies of Trust, this is not any law but its clear that you are trusting a provider with your most valuable assets to manage.

What Do They Provide?

Cap table providers need to offer a range of services designed to streamline the complex process of cap table management for private companies. These services typically include:

→ Initial Setup: They will help you create your cap table from scratch, ensuring that all equity and securities are accurately recorded from day one.

→ Transaction Tracking: Providers keep a detailed record of all equity transactions, including investments, stock issuances, option grants, warrants, safe, saft, notes, digital securities, NFT, and more.

→ Compliance Monitoring: They ensure that your cap table adheres to all legal and regulatory requirements, including securities laws, tax laws, and accounting standards.

→ Scenario Modeling “Waterfalls”: Cap table providers can help you run “what-if” scenarios to understand the impact of various financial decisions on equity ownership and dilution. This is often referred to as “waterfall” modeling.

→ Shareholder Reporting: They generate reports and statements for your investors, making it easier to communicate and maintain transparency. Very important element to make sure reports such as K1, dividends, AGM etc are delivered in a timely manner.

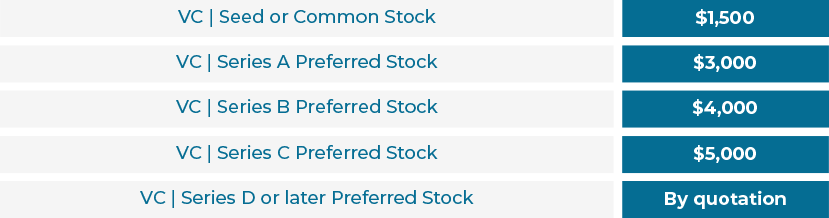

→ Valuation Management: Providers assist in tracking the valuation of your company over time, which is vital for determining the worth of individual equity stakes. For private companies 409a reporting is critical and also mandated.

→ Exit Planning: As your company grows, they help you prepare for exit events such as mergers, acquisitions, or initial public offerings (IPOs).

Why It’s Important to Work with a 3rd Party Provider

Choosing a trusted cap table provider is not just an option; it’s a strategic necessity for any private company, especially those raising capital online and utilizing the JOBS Act Regulations such as RegCF, RegD, and RegA+. Here’s why:

1. Expertise and Accuracy

Cap table management requires specialized knowledge of securities laws, tax regulations, and accounting standards. A third-party provider brings expertise to the table, ensuring your cap table is accurate and compliant, reducing the risk of costly errors. Today, the movement of securities such as transfers and trades you need experts to maintain your book of records accurate.

2. Scalability

As your company grows, managing your cap table becomes increasingly complex. A provider has the resources and tools to handle the growing complexity, allowing you to focus on your core business operations.

3. Transparency

A third-party provider adds a layer of transparency between your company and its investors. This transparency fosters trust and confidence, vital for attracting and retaining shareholders.

4. Security and Confidentiality

Your cap table contains sensitive information about your shareholders and the financial health of your company. Trusting a third-party provider with this data ensures that it remains secure and confidential. TRUST is not technology, TRUST is not regulations, TRUST needs to be the DNA of the company.

5. Regulatory Compliance

Securities laws and regulations are constantly evolving. A cap table provider stays updated with these changes, helping your company stay compliant and avoid legal issues.

Choosing a trusted cap table provider

Perhaps the most critical aspect of choosing a cap table provider is TRUST. Your company is entrusting the provider with one of its most valuable assets: its shareholders. Here’s why trust is of utmost importance:

| Factor | Description |

|---|---|

| Confidentiality | A trusted cap table provider understands the importance of keeping your shareholder information confidential. They have robust security measures in place to safeguard this data from unauthorized access or breaches. Not only managing securely but making sure the provider is not using your data. |

| Accuracy | Errors in your cap table can lead to disputes, legal issues, and even damage your company’s reputation. Trustworthy providers have rigorous quality control processes in place to ensure the accuracy of your cap table. |

| Responsiveness | In the fast-paced world of business, you need a provider who is responsive to your needs. Trustworthy providers prioritize client communication and support, ensuring your concerns are addressed promptly. |

| Compliance | Trustworthy providers are well-versed in securities regulations and take compliance seriously. They help your company stay on the right side of the law, reducing the risk of regulatory trouble. A cap table provider should provide your company with a TRUST document that is beyond external regulatory compliance. |

| Reputation | A provider’s reputation matters. Check their track record, client testimonials, and industry reputation to ensure they have a history of delivering quality service. |

For CEOs, Presidents, CFOs, COOs, Chief Legal Counsel, and Lawyers, selecting a trusted cap table provider is a strategic decision that can greatly impact your company’s success, especially when raising capital online.

The right provider offers TRUST, expertise, scalability, transparency, and security. Above all, TRUST between your company and the provider is paramount, as they safeguard your most valuable assets—your shareholders. By choosing a reputable provider, you can navigate the complex world of cap table management with confidence, knowing that your financial records are in capable hands.